Medicare Enrollment Periods: Where – and When – do You Fit in?

November 06, 2021 | Tags:

Once you know the A, B, Cs – and Ds – of Medicare and the differences between Medicare Advantage and Medicare Supplement, it’s time to consider when to sign up. There are specific times when you can enroll in or change Medicare plans. Let’s learn about each one:

Initial Enrollment Period

If you’re approaching age 65, you are eligible to enroll in Medicare for the first time during your Initial Enrollment Period (IEP). This window of time includes:

- The three months before the month of your 65th birthday

- The month you turn 65

- The three months after your 65th birthday

If you are still working and covered under your (or your spouse’s) employer group health plan when you turn 65, you may have the option not to enroll in Medicare during your IEP. In this case:

- You will be eligible to enroll at a later age when you retire

- When you retire, you’ll have eight months to enroll in Medicare after your employment ends or after your group coverage ends, whichever comes first

The employer size determines whether a beneficiary can delay enrolling in Part A and Part B without paying a penalty. Generally, if the employer has over 20 employees, you could delay Part B. If your (or your spouse’s) employer has 20 or more employees, talk to the employer for more details on a later enrollment if you have a group insurance plan.

You must enroll in Original Medicare (Part A and Part B) before you can enroll in a Medicare Advantage (Part C) or Medicare Supplement plan.

Other Enrollment Periods

General Enrollment Period

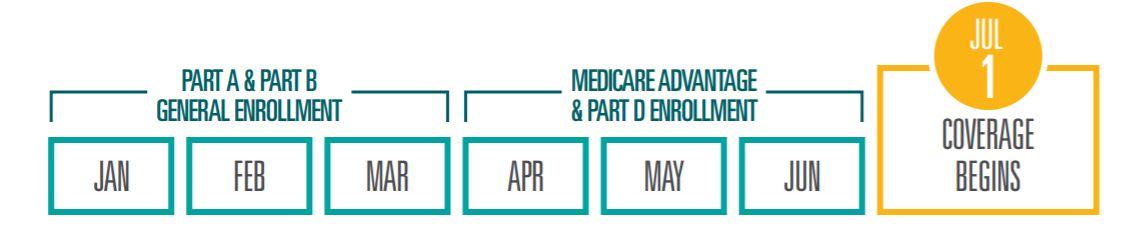

If you miss your IEP window, you can enroll in Original Medicare during the next General Enrollment Period. You may have to pay a higher premium for late enrollment in Medicare Part A and/or a higher premium for late enrollment in Medicare Part B. How it works:

- You can enroll in Original Medicare from Jan. 1 through March 31

- You will then be eligible to enroll in a Medicare Advantage plan or a prescription drug (Part D) plan from April 1 through June 30

- If you enroll in Medicare during the General Enrollment Period, your coverage will start on July 1 of the same year

Annual Enrollment Period

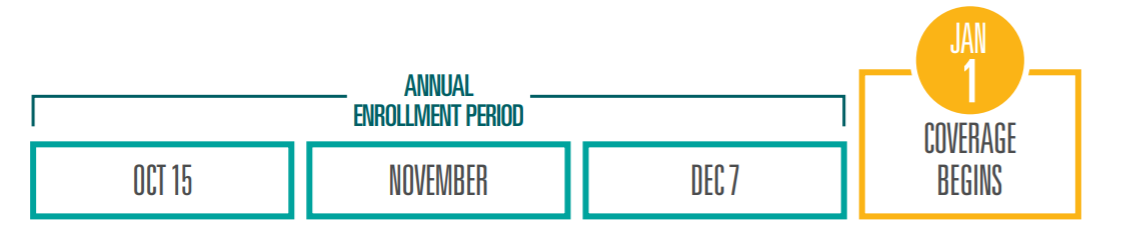

You can enroll in a Medicare Advantage plan or make a change to your existing Medicare Advantage plan and/or prescription drug plan during the Annual Enrollment Period (AEP) each year. This period:

- Begins on Oct. 15

- Ends on Dec. 7

If you make changes during AEP, your new plan will start on Jan. 1 of the following year.

Medicare Supplement Open Enrollment Period

The best time to enroll in a Medicare Supplement plan is during your six-month Medicare Supplement Open Enrollment Period, which starts the first day of the month you are more than 65 years old and enrolled in Medicare Part B. You may apply for Medicare Supplement coverage outside of this six-month window, but if you do, there is a possibility you will pay a higher premium or be denied coverage based on your medical history.

You cannot enroll in both a Medicare Advantage plan as well as a Medicare Supplement Plan at the same time.

Special Enrollment Period

Certain situations may make you eligible to change your Medicare Advantage plan outside of AEP. This chance to make a change is called a Special Enrollment Period (SEP). Rules about making changes are different for each SEP, and some of the circumstances include:

- Moving into/outside of the plan’s service area

- Qualifying for Extra Help/Low-Income Subsidy (a program that helps pay for Medicare prescription drug plan costs)

- Moving into a nursing home or other institution

- Becoming eligible for both Medicare and Medicaid

- Loss of employer coverage

If you have questions about whether you qualify for an SEP or any of the other enrollment periods, you can speak to a licensed Medical Mutual agent by calling toll free at 1-866-406-8777 (TTY: 711).

For more details on enrollment periods, visit Medicare.gov or download our Understanding Medicare Guide. Next time, we’ll be reviewing how Medicare works with your employer-sponsored group plan.

You can talk to a Medical Mutual licensed insurance agent who can answer your questions by calling (866) 406-8777 (hearing impaired TTY/TDD: 711) or call your insurance agent. You can also visit Medicare.gov for more information.

This site contains a summary of benefits only describing our policies’ most important features. It is not an insurance policy or contract. The Medical Mutual Medicare Supplement Insurance policy is the insurance contract. If there is any different between this site and the policy, the provisions of the policy will control.

Neither Medical Mutual nor any of its agents or Medicare Supplement insurance plans are connected with or endorsed by the U.S. or state government, Social Security or federal Medicare program. Individuals who call the phone number listed will speak with a licensed insurance agent.

This policy has exclusions, limitations, reduction of benefits and terms under which the policy may be continued in force or discontinued. For costs and complete details of the coverage, call or write your insurance agent or Medical Mutual.

Medicare Supplement products marketed by Medical Mutual will be underwritten by Medical Health Insuring Corporation of Ohio. Contact will be made by a licensed insurance agent or insurer. The amount of benefits provided depends upon the plan selected and the premium will vary with the amount of the benefits selected. Medical Mutual is a registered trademark of Medical Mutual of Ohio.